What are the other expenses of building a custom house in Japan?

When building a custom-built house in Japan, there are other expenses that have probably never crossed your mind in addition to land cost, construction cost, and architect fees. In order for you to make a steady budget plan, we will explain what kind of "other expenses" you will need to factor into the building process in Japan. Please make sure to take into account these hidden expenses so you can make a steady budget plan for building your dream house in Japan.

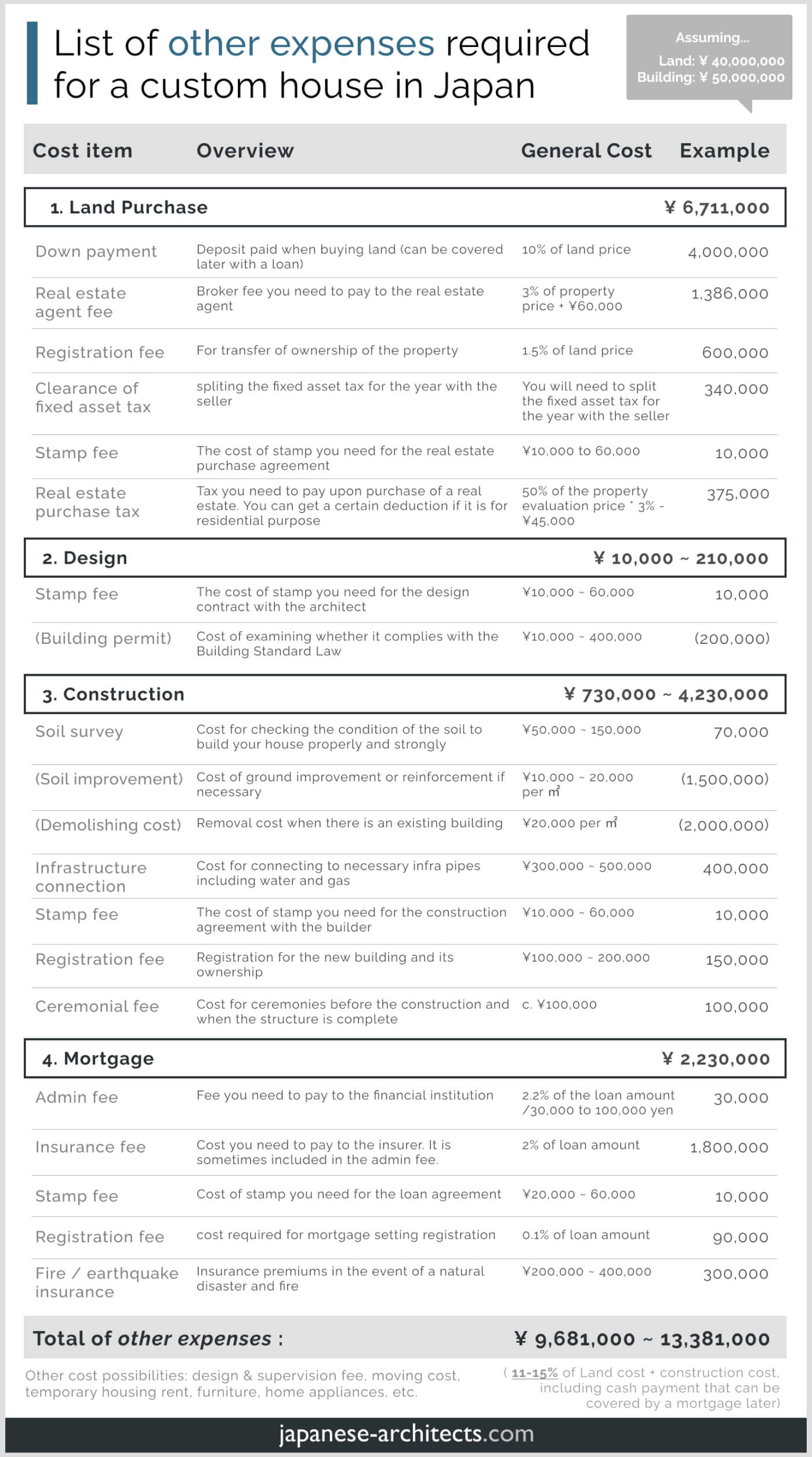

In summary:

- The market average of other expenses of building a single-family house in Japan generally ranges from 10% to 20% of the total amount of land and construction cost.

- There are mainly five major phases in which you will have to pay different items of miscellaneous expenses.

- Some of the ways to save other expenses are to use bridge loans or installment loans when applying for a house loan with a bank and to ask your architect to include expenses of furniture and appliances in the construction budget.

Table of Contents:

- 1. Detailed breakdown of other expenses

- 2. Simulation and breakdown of expenses for land purchase

- 3. Simulation and breakdown of costs in the design process

- 4. Simulation and breakdown of construction cost

- 5. Simulation and breakdown of mortgage cost

- 6. Other expenses

- 7. How can you mitigate cash payout?

- 8. Summary

1. "5 major phases" of other expenses

In most cases, other expenses of a custom-built house are generally 10% to 20% of the total amount of land and construction cost.

For example, if you simulate construction of a 50 million yen building on 40 million yen land, general miscellaneous expense would be about 13.5 ~ 22.5 million yen.

When planning a budget, it is very important to include not only the cost of the land and construction but also other expenses in advance. In addition, these expenses generally cannot be included in a mortgage and must be paid in cash.

Payment of miscellaneous expenses for a custom-built house can be roughly divided into the following processes:

- Land purchase

- Building design

- Construction

- Mortgage

- Other

The five processes typically occur in the following order. Please find a detailed description of each in the following sections.

2. Simulation and breakdown of expenses for land purchase

First, let's see the breakdown of other expenses involved in purchasing land and run a simulation based on the market average.

(Assumption: building a 50 million yen building on a 40 million yen land)

| Item | Overview | General Expense | Simulation |

|---|---|---|---|

| Down payment | Payment required upon signing of a purchase agreement. The paid amount will be deducted from the final payment. | c. 10% of property price | ¥ 4,000,000 |

| Real estate agent fee |

Broker fee you need to pay to the real estate agent | 3% of property price + ¥60,000 | ¥ 1,386,000 |

| Registration fee | For transfer of ownership of the property | 1.5% of the property evaluation price (assuming the evaluation price to be 70% of purchase price) | ¥ 600,000 |

| Clearance of fixed asset tax | You will need to split the fixed asset tax for the year with the seller, mostly based on the number of days of each ownership | c. 1.7% of the property price x (number of days you own in the first year ÷ 365) | ¥ 340,000 |

| Stamp fee (印紙代) |

The cost of stamp you need for the real estate purchase agreement | ¥ 10,000 ~ 60,000 | ¥ 10,000 |

| Real estate purchase tax | Tax you need to pay upon purchase of a real estate. You can get a certain deduction if it is for residential purpose | 50% of the property evaluation price * 3% - ¥45,000 (assuming the evaluation price to be 70% of purchase price) | ¥ 375,000 |

Subtotal: ¥ 6,711,000

3. Simulation and breakdown of costs in the design process

Next, let's run a simulation on the breakdown of other expenses involved in the designing process when building a house.

(Assumption: building a 50 million yen building on a 40 million yen land)

| Item | Overview | General Expense | Simulation |

|---|---|---|---|

| Stamp fee (印紙代) |

The cost of stamp you need for the design contract with the architect | ¥ 10,000 ~ 60,000 | ¥ 10,000 |

| (Building permit) | Cost of examining whether it complies with the Building Standard Law (usually included in design fee) |

¥ 100,000 ~ 400,000 | (¥ 200,000) |

Subtotal: ¥ 10,000 ~ 210,000

These fees are the amount paid to the design firm or house builder when the house design is being developed. In many cases, when you hire a design firm / architect office, the design and supervision fees are paid in several installments as the project progresses.

This fee is charged when you hire an architect to design a house and supervise the construction. The design fee is often 10~20% of the construction cost (the rate varies depending on the house maker or the design office). Structural engineering fees are often included but we recommend checking in advance.

The amount of the design and supervision fee and the timing of payment vary from each architect office and house builder, so it is a good idea to check before commissioning a design.

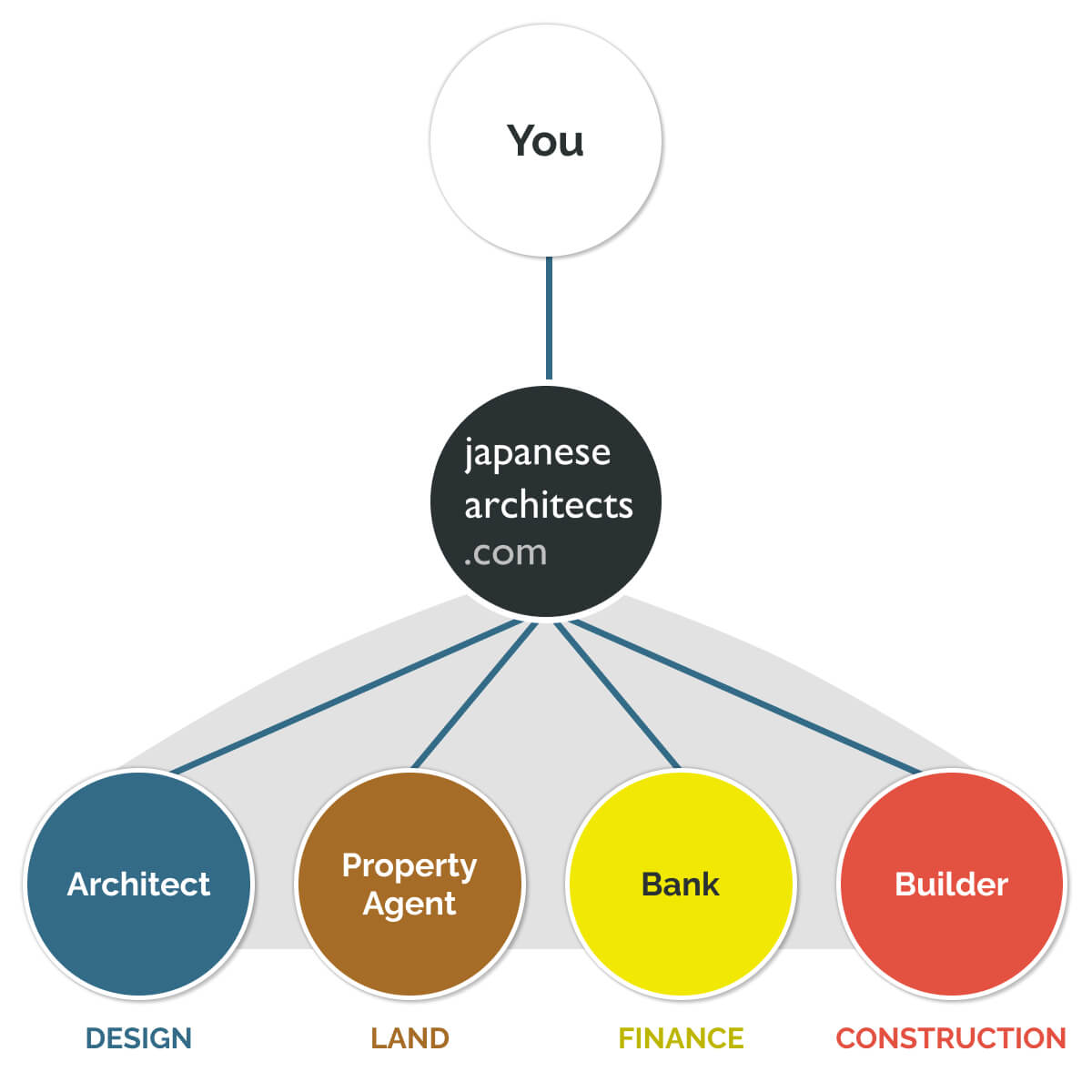

Also, depending on the discussions with the bank and the architects, the design fee can be included in the loan. We recommend you make early decisions on the architect selection. Haven't decided on the architect you want to work with? japanese-architects.com provides architect network covering all areas in Japan. Please contact our local advisors and get to know your most suitable architect for building your dream house.

4. Simulation and breakdown of construction cost

Obviously, you will also need to take into account other expenses in the construction process pelow.

(Assumption: building a 50 million yen building on a 40 million yen land)

| Item | Overview | General Expense | Simulation |

|---|---|---|---|

| Soil survey | Cost required for checking the condition of the soil in order to build your house properly and strongly | ¥ 50,000 ~ 150,000 | ¥ 70,000 |

| (Soil improvement) | Cost required if your soil was not strong enough based on the soil survey result. The price will vary based on the soil condition as well as the area you need improvement | ¥10,000 ~ 20,000 per m2 (of soil which needs improvement) | ¥ 1,500,000 |

| (Demolishing cost) | Removal cost when there is an existing building (assuming regular wooden house with 100 m2 floor area) | 20,000 yen per m2 (of total floor area) | ¥ 2,000,000 |

| Infrastructure connection | Cost for connecting to necessary infrastructure pipes, including water and gas | ¥ 300,000 ~ 500,000 | ¥ 400,000 |

| Stamp fee (印紙代) |

The cost of stamp you need for the construction agreement with the builder | ¥ 10,000 ~ 60,000 | ¥ 10,000 |

| Registration fee | Registration for the new building and its ownership | ¥ 100,000 ~ 200,000 | ¥ 150,000 |

| Ceremonial fee (地鎮祭・上棟式) |

Most of the houses in Japan hold a ritual event before the construction starts and at the timing when the structure is complete | c. ¥100,000 | ¥100,000 |

Subtotal: ¥ 730,000 ~ 4,230,000

It is important to have the architect explain what is and is not included in the "construction cost" while carefully reviewing the estimate.

Some architects or housebuilders do not deal with exterior construction work (planting, terraces, parking, gates, fences, or other exterior-related work), in which in this case it is necessary to engage a separate professional for exterior construction work.

In addition, payments are generally requested in installments such as "30% at the start of construction", "30% in the interim", and "40% at completion" (the construction cost or payment schedule will depend on the scale and structure of the house). We recommend confirming the timing of all payments before you officially hire the contractor.

When paying in installments, the amount to be paid at the start of construction or in the interim may be covered by personal funds, or some banks may offer bridge loans for this purpose. If you want to make sure all your payments are planned thoroughly, please feel free to contact our professionals for free to get tailor-made advice from an expert.

5. Simulation and breakdown of mortgage cost

There will also be expenses related to mortgages if you will be taking out bank loans.

(Assumption: building a 50 million yen building on a 40 million yen land)

| Item | Overview | General Expense | Simulation |

|---|---|---|---|

| Admin fee | Fee you need to pay to the financial institution. Important to compare the total amount of admin fee and insurance fee. | (a) around 2.2% of the lending amount or (b) ¥33,000 + insurance fee (both including tax) |

¥ 30,000 |

| Insurance fee | Cost you need to pay to the insurer. It is sometimes included in the admin fee. There are some products where you also have incremental rates on your interest (around 0.2%) | 2% of loan amount | ¥ 1,800,000 |

| Stamp fee (印紙代) |

The cost of stamp you need for the loan agreement with the financial institution | ¥ 10,000 ~ 60,000 | ¥ 10,000 |

| Registration fee | You will need additional registration for setting your property as the collateral | 0.1% of loan amount | ¥ 90,000 |

| Fire insurance | Mostly mandatory to apply for a fire insurance when you take out a loan | ¥ 200,000 ~ 400,000 | ¥ 300,000 |

Subtotal: ¥ 2,230,000

6. Other expenses

Besides these expenses, you will also need to consider the following costs as necessary:

- Moving expenses

- Temporary housing costs

- Cost of buying furniture

- Cost of buying equipment and appliances

These specific costs will vary greatly depending on family structure, lifestyle, region, and the timing of the move.

In addition, obtaining a housing performance evaluation (住宅性能評価) which may qualify for preferential interest rates on mortgages, or certification as a superior long-term housing (長期優良住宅) you will need for certain subsidies, could cost between ¥100,000 and ¥1,000,000, depending on each case.

7. How can you mitigate cash payout?

As each payment may be a material burden for your cash on hand, what are the possible ways you can consider to mitigate your cash payout and save as much cash as possible?

7-1. Use bridge loans

Some banks offer loans in installments from when the construction contract is signed. The interest rate is often more expensive than that of a regular mortgage loan.

7-2. Incorporate furniture and appliances into the construction cost

Normally, the cost of furniture and appliances cannot be included in the mortgage loan.

However, you can include the furniture and appliances cost as part of the construction cost if you build original furniture or built-in ances as part of the building, increasing what can be covered by the mortgage and reducing the cash payout for furniture and appliances.

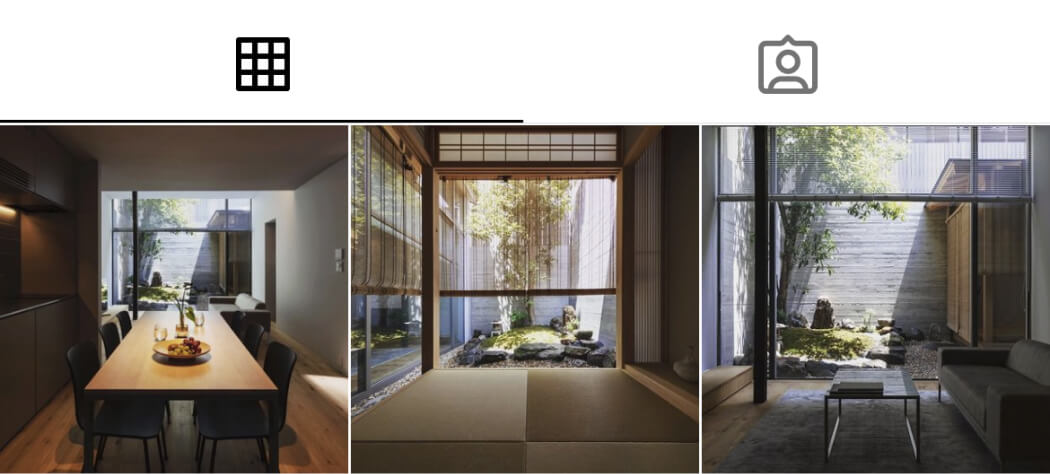

When working with an architect on a custom-built home, the design is detailed down to the height of the kitchen or the vanity, or the size of the storage space. For example, in order to make a fully-customized house with more costs covered by the mortgage, you can:

- Design cabinets with built-in dishwashers / ovens / washing machines

- Build the dining table as an integral part of the kitchen

- Build bookshelves to match the width of the room

- Build a sofa that is integrated into the living space

All costs in the above cases are included in the construction cost and are eligible for the mortgage. Curtains, blinds, and lighting fixtures can also be considered during the design process to match the space and be installed as part of the construction.

8. Summary

In addition to the main cost for the land purchase and construction, this article reviewed the detailed breakdown of how much other expenses will be. We highly suggest that you take these into account in your financial planning for your custom-built home in advance.

Please note that the figures shown in this article are reference prices based on the market price of average houses. If you want to know what it would be like in your own case, please talk to an expert from japanese-architects.com for free and get a professional consultation.