What is the final screening process for loan applications for foreigners?

~Find out the eligibility and required documents to avoid screening failure~

Since the purchase price of a home can amount to or exceed tens of millions of yen, the applicant, who will repay the loan over a long period of time, must undergo a careful examination by the financial institution. The contractor's annual income, status of employment and income, value of the property are reviewed during the screening process.

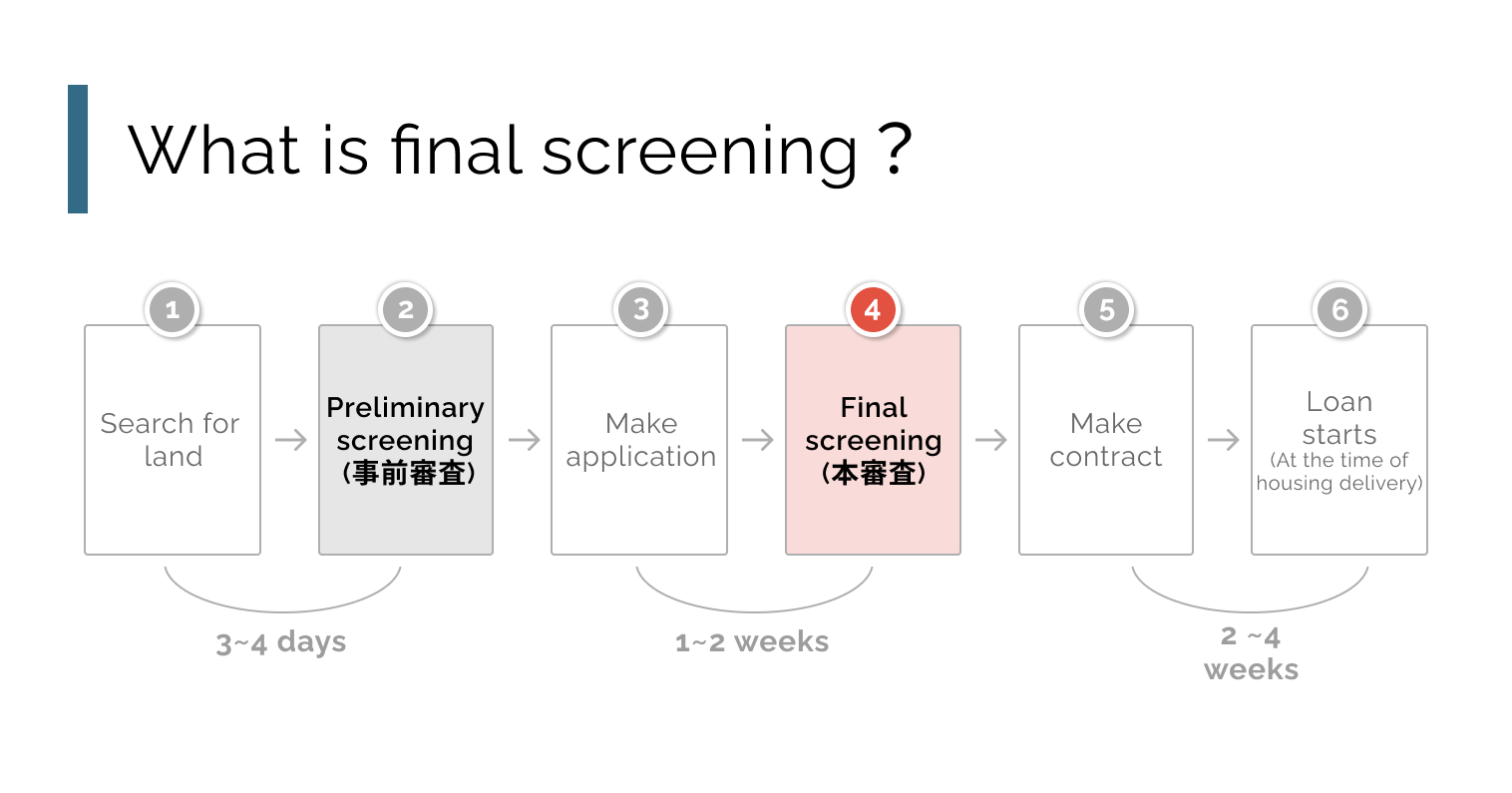

Depending on the bank to which you apply, most types of house loans have two levels of approvals. In the previous article we explained the first process called preliminary screening(事前審査). In this article we will specifically discuss the final screening(本審査) for those who have passed the pre-screening successfully. Once the submitted documents have been verified and the applicant has successfully passed the final screening, the loan contract can be signed.

Quick Summary

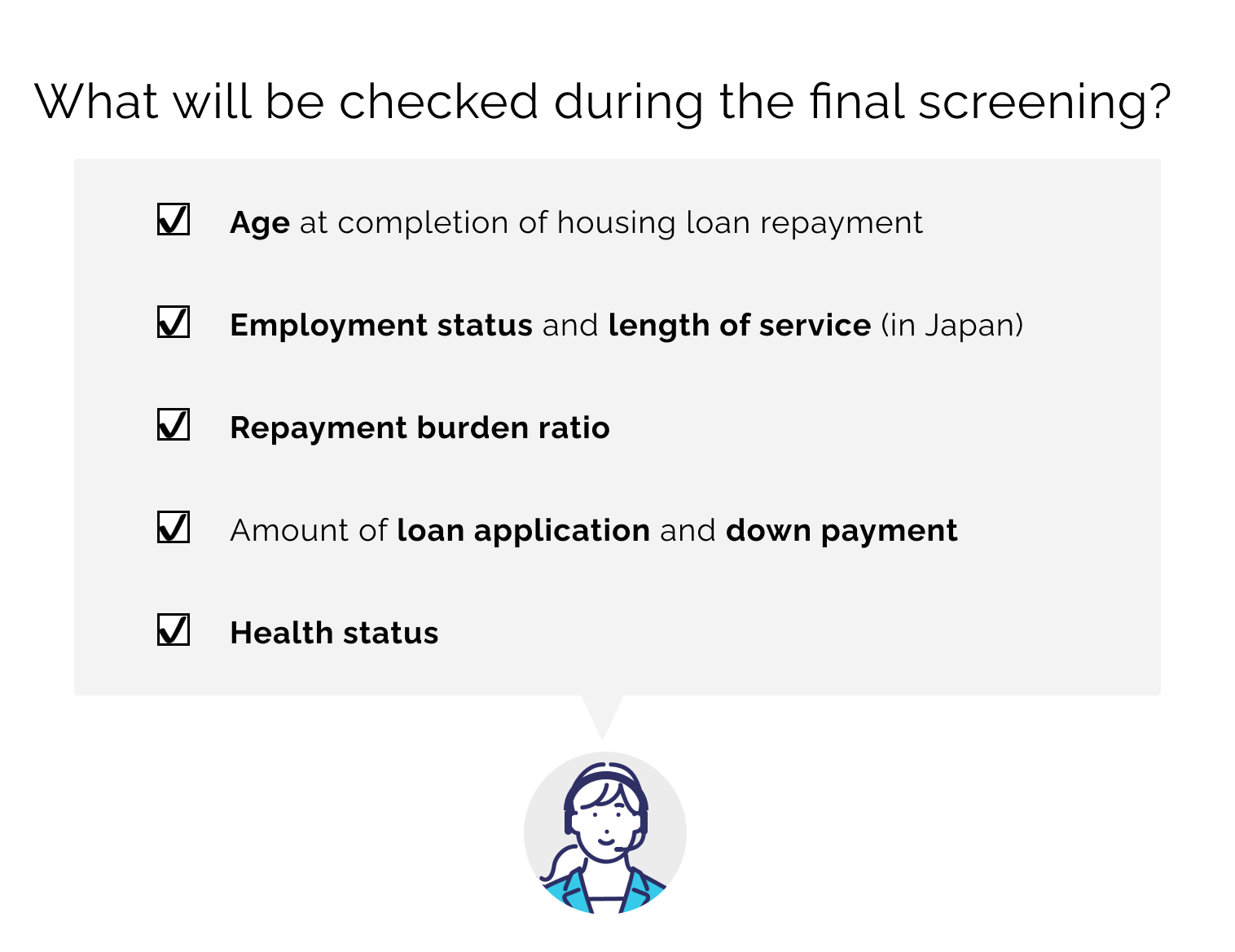

Although it varies from bank to bank, the following items will be reviewed during the final screening:

- Age at repayment

- Type of employment

- Employment status

- Length of residence in Japan

- Health status

- Repayment rate

- Land and building collateral value

Table of Contents - Can foreigners get a house loan review while searching for a property?:

1. What is the final screening?

If you pass the preliminary screening, it is time for the final screening(本審査). The preliminary screening is conducted by each financial institution's branch office, while the final screening is conducted by the financial institution's headquarters and the credit guarantee company. In other words, the final screening is more rigorous. Since multiple documents need to be submitted for the final screening compared to the simple requirements of the preliminary screening, the examination generally takes at least one week. The applicant will be required to submit withholding tax statements, income certificates, certificate of seal-impression and more. In addition, you must prepare the sales contract for the property, rough building plans, and construction estimation in advance, so please make sure that they are completed before undergoing the final review. Once the submitted documents have been verified and you have successfully passed the main inspection, you will be qualified to sign the loan contract.

2. What is important in the main screening process?

2-1. Age at completion of housing loan repayment

Age at full repayment (完済時年齢)is one of the most important factors in the house loan process. Most financial institutions require the age at full repayment to be 80 years old or younger. However, the exact age varies from financial institution. Please contact each bank to confirm the exact age before applying. According to the “2020 Report on the Actual Conditions of Private Mortgage Loans ”, 99.1% of financial institutions list age at repayment as a first criteria they consider for final screening. If you are considering taking out a long-term loan, it would be advantageous to apply when you are young.

2-2. Employment status and length of service (in Japan)

Employment status, such as whether the contractor is a full-time employee or self-employed and whether the contractor has been with the company for a certain period of time, are examined in more detail than in the preliminary screening. If you are a company owner or self-employed, not only your personal annual income but also the financial results of your business will be reviewed. It may be disadvantageous to the applicant in the final screening process if the company's performance is poor, or if the company's profit is low. Additionally, in the case of non-Japanese nationals, the requirement is that they must have some degree (at least six months) of residency in Japan to provide an income tax record.

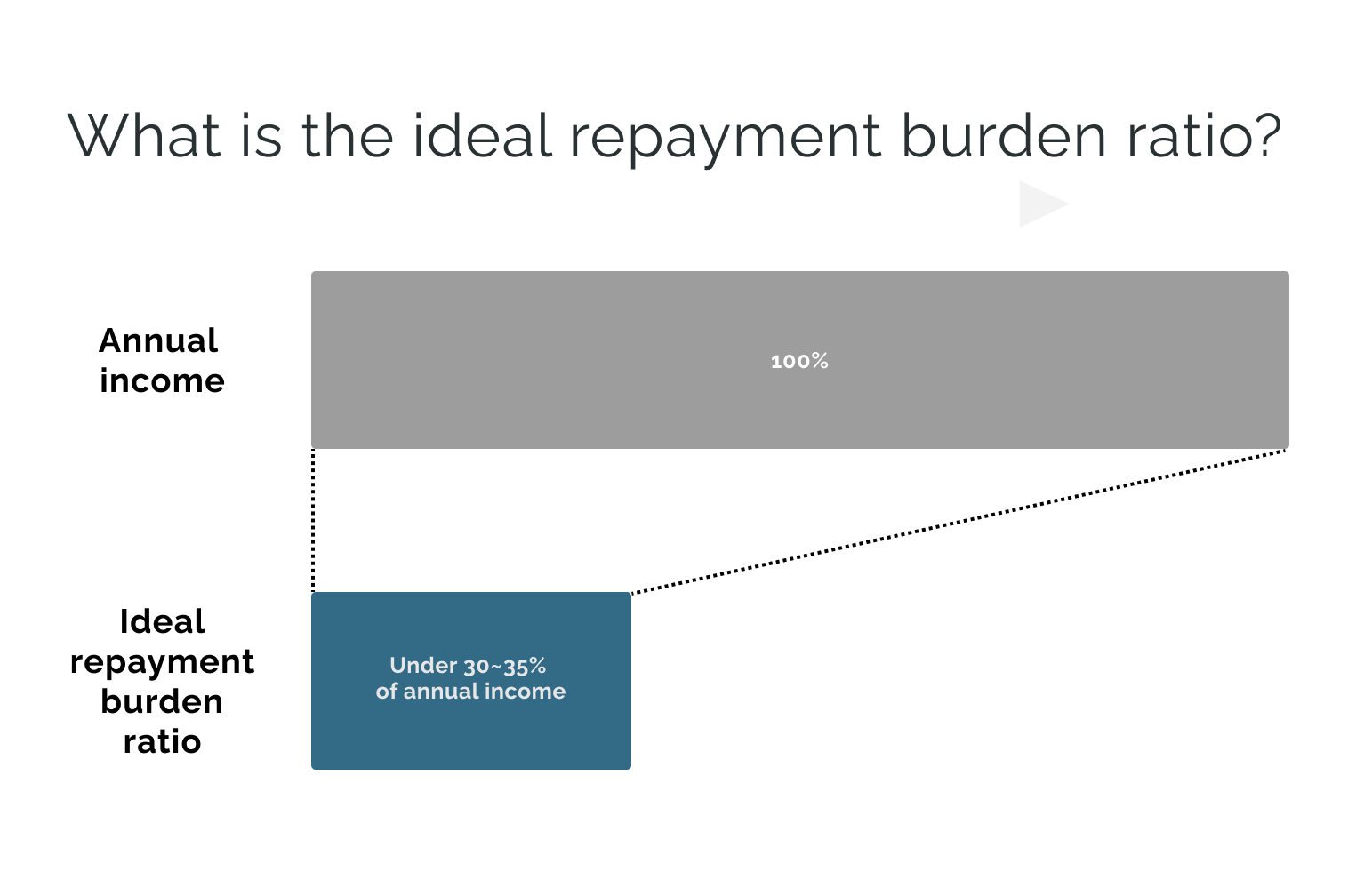

2-3. Repayment burden ratio

Repayment burden ratio(返済負担率) is the ratio of the repayment amount to your annual income before taxes. If you have outstanding loans other than the house loan, the amount of those loans will be added to the annual repayment amount, and if the final repayment burden ratio is within 30-35%, it is generally considered that the loan will meet the final screening criteria.

Repayment burden ratio = annual repayment amount ÷ annual income (with tax)×100

2-4. Amount of loan application and down payment

The loan application amount(借り入れ申込み金額) is the loan amount you wish to borrow. The down payment(頭金) is the total price of the house minus the borrowing amount. You can of course take out a "full loan" without any down payment, however, you can lessen your future burden by paying a certain amount of down payment and reducing your interest expenseM. Although it is possible to apply for a house loan without a down payment, there are a few points to make note of. First of all, if you take out a loan without any down payment, the loan application amount will increase, which may lead to a higher repayment burden. Also, when considering a resale, you will need to make up the difference with your own funds if the mortgage balance is greater than sale price. It is important to set a good balance of loan application amount and down payment in order to make a reasonable repayment plan.

Approximate amount of down payment to be prepared:

According to the "Survey of Housing Market Trends in Fiscal Year 2019 " published by the Ministry of Land, Infrastructure, Transport and Tourism, the amount of personal funds and the percentage of personal funds for custom-built houses are as follows:

Custom-built housing (including land costs):

12.54 million yen in personal funds, 27.2% personal funds ratio

This shows that 27% of the construction cost is self-financing for new custom-made homes. However, these values are only averages and the actual amount of the down payment should be determined by the annual household income and expenditures for future life events of each applicant. If you are currently living in rented housing, it is one way of thinking to set your ballpark monthly repayment amount based on your monthly rent. For example, if you are paying ¥200,000 monthly rent, a similar amount can be your monthly repayment amount. Then try to calculate your ideal down payment which will be sufficient to keep your monthly expenses within your capacity.

2-5. Health status

In most cases, if the applicant's health is not good enough to qualify for group credit life insurance, he or she will not be approved for a house loan.

3. Comparison between the preliminary screening and final screening

| Preliminary screening (事前審査) |

Final screening (本審査) |

|

|---|---|---|

| Screening organization |

Banks and other financial institutions |

Banks and credit guarantee companies |

| Period | 3~4 days | 1~2 weeks |

| Examination Details |

Simple verification of ・Age and income ・Permanent residence ・Occupation etc |

Detailed verification of ・Age at repayment ・Type of employment ・Employment status ・Length of residence in Japan ・Health status ・Repayment rate etc |

| ※For foreign house loans, some financial institutions combine the preliminary and the final screening at once. For more details, please contact japanese-architects.com or each financial institution directly. | ||

In most cases, this final screening is conducted not only by the financial institution but also by the guarantee company. Also, the result of the pre-screening takes 3~4 days, but the final screening takes 1~2 weeks. More detailed information will be examined in the final screening, such as work status and health condition. To add, most financial institutions require you to submit land information and a simple building plan at this point, therefore it is safer to decide on an architect before going through the final examination.

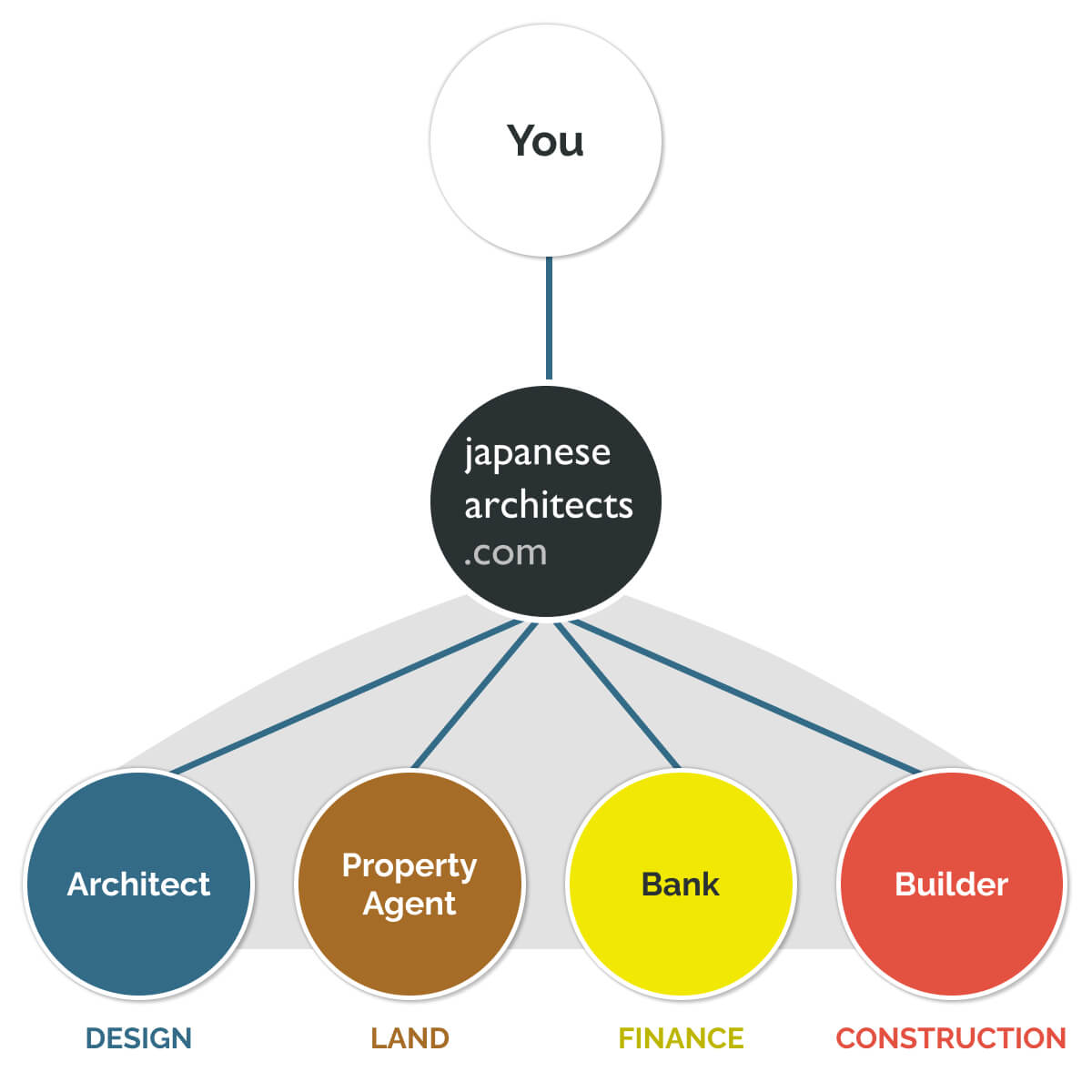

Do you need help in finding a property and an architect? japanese-architects.com is the platform that makes it easier than ever for you to find the most experienced Japanese architect for their project. Get in touch with us for free and talk to a professional to get started.

4. Key points and required documents to pass the final screening

There have been cases where applicants have gone through the trouble of passing the preliminary screening, only to be dropped in the final screening. To avoid disappointment at the end of the process, we summarized the key points to pass the screening successfully:

4-1. Please check that there are no discrepancies with the contents of the preliminary screening declaration

Please make sure that there are no discrepancies in your declarations between the documents you submitted for the preliminary and final screening. For example, you may not be able to borrow up to your requested amount if your annual income drops later for some reason, such as if you change jobs during the screening process. In the worst-case scenario, you may not even pass the screening itself.

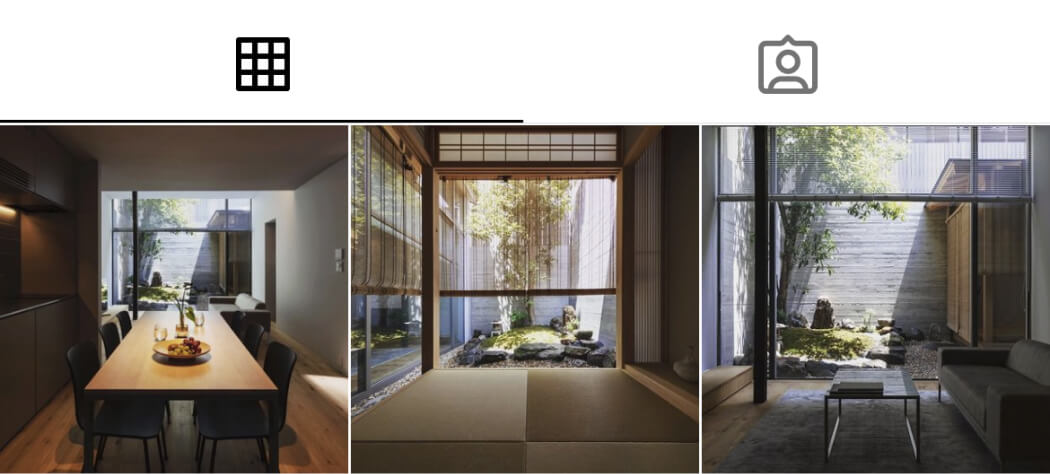

4-2. Hire an architect to make plans to ensure that the amount of collateral valuation does not fluctuate

One of the major differences between the preliminary and final screening process is that the property and the building value will be examined in detail during the final screening. Especially when building a custom-built house, there may be cases where the property is somewhat different from the architectural images at the time of the preliminary screening. If the collateral value is calculated to be low, the loan may not reach the requested amount and will likely be refused. We strongly recommend that you decide on the land and hire an architect prior to the final review. By asking a professional architect to simulate the construction costs, you can have them prepare the necessary documents and drawings for the final screening.

4-3. Avoid new borrowings after pre-screening

It is safe to avoid taking out a cash advance or getting a new credit card after passing the pre-screening. If you take out a cash advance or other loan and are late with the payment, you will almost certainly have no chance of passing the final screening. It is not commonly known but the banks will review all your financial situations, including other borrowings for your cars or electronic devices or small issues such as if you are not behind on all your bills.

Documents required for this screening:

※ Please be sure to inquire with each financial institution in advance, as the required documents may differ depending on the banks and individual conditions

- Personal seal(実印)

- Certificate of residence

- Certificate of seal impression(印鑑証明書)

- Certificate of taxation(課税証明証)

- Certificate of withholding tax(源泉徴収票)or other documents that verify your income

- Identification card (residence card, passport, driver's license, health insurance card, etc. )

- Sales contract (real estate sales contract or statement of important matters, etc.)

- Copies of brochures, flyers, property summaries, price lists, or other documents that verify the contents of the land property

- Rough construction plan drawings

- Rough construction cost estimate

As for most documents listed above, you can ask the real estate agency you are dealing with to make sure you have everything you need. Please consult with your architect for items in red. Most of these items, which are required at the time of loan preparation, can be done free of charge within the scope of the architect’s design fee for your building if you have your architect decided beforehand.

See also:

5. Summary

Although it varies from bank to bank, the final screening review is a detailed examination of the applicant and the property itself. The contractor examination mainly covers the followings:

- Age at full repayment

- Employment status

- Type of employment and length of service in Japan

- Repayment burden ratio

- Amount of loan application and down payment

- Health condition

- Collateral valuation (calculated from the land price, a temporary plan of the building and an estimate of construction costs)

Since the required documents are more extensive than those for the preliminary screening, the key to expediting the screening process is to ensure that no omissions are made. In addition, since the collateral for the land and building must be evaluated, be sure to find an architect prior to the final examination if you wish to build a custom-built home.

japanese-architects.com will guide you to the most suitable architect. We will be your partner with comprehensive support for everything you need to build a house in Japan. Get in touch with us for freeand talk to a professional to get started.