Financial institutions offering house loans for foreigners

As explained in the previous article , there are two stages in the loan screening process: the preliminary screening and the final screening. Since the screening items are different between the preliminary and final screening, the time required for each screening is also different. Furthermore, it is not as easy for foreigners to obtain a house loan at Japanese financial institutions since most of them require applicants to be Japanese citizens or have a permanent residence permit. However, there are some financial institutions that can lend money to foreigners who do not have a permanent residence permit and can apply for a loan if certain conditions are met. In this article, we will describe the specific conditions for foreigners to obtain a house loan and where to actually apply.

Financial institutions offering house loans for foreigners

1. Screening Criteria for applying for permanent residency

While many countries do not allow foreigners to own real estate, foreigners in Japan are allowed to purchase and own it in the same manner as Japanese nationals. However, it is not as easy for foreigners to obtain a house loan from Japanese financial institutions. This is because most Japanese financial institutions require applicants to be a Japanese citizen or have a permanent residence.

Permanent residence is one of the residence statuses that can be obtained by foreigners who wish to stay in Japan in the long-term. If you want to purchase a home with the intention of living in Japan for a long time, obtaining a permanent residence is the most reliable way to do so. The following three conditions must be met in order to obtain a permanent residence. With certain exceptions, foreigners who have lived in Japan for 10 years or more and who meet the following criteria are basically eligible to obtain a permanent residence permit.

Three screening Criteria for Permanent Residence Permits:

-

① Person with a good conduct and behavior

The applicant must be law-abiding and lead a socially acceptable life as a resident in everyday life.

-

② Have sufficient assets or skills to earn an independent living

The applicant must not be a burden to the public in his/her daily life, and must be expected to have a stable life in the future in view of his/her assets or skills, etc.

-

③ The permanent residence of the person is deemed to be in the best interest of Japan

In order to benefit from Japan, the following points must also be met:

- You must have resided in Japan for at least 10 years (※special exceptions apply), of which at least 5 years must have been spent in Japan with work or residence status. (原則として引き続き10年以上本邦に在留していること。ただし,この期間のうち,就労資格(在留資格「技能実習」及び「特定技能1号」を除く。)又は居住資格をもって引き続き5年以上在留していることを要する。)

- You must not have been sentenced to a fine or imprisonment. (罰金刑や懲役刑などを受けていないこと。)

- You must be in compliance with tax payment, insurance premium payment, and notification obligations as stipulated in the Immigration Control Act, etc. (公的義務(納税,公的年金及び公的医療保険の保険料の納付並びに出入国管理及び難民認定法に定める届出等の義務)を適正に履行していること。)

- You are residing in Japan with the longest residency period permission (mostly 5 years) (現に有している在留資格について,出入国管理及び難民認定法施行規則別表第2に規定されている最長の在留期間をもって在留していること。)

- You must have no risk of harm from a public health standpoint. (公衆衛生上の観点から有害となるおそれがないこと。)

Source: Imigration Services Agency of Japan

It is possible to obtain permanent resident status as long as the applicant has a stable income and good behavior. It is advisable to apply as early as possible if you want to apply for a house loan since it is said that it takes about 4 months to examine the application.

※ special exceptions

Even if you have not resided in Japan for more than 10 years, there are special cases where you can obtain a permanent resident permit if, for example, you have become the spouse of a Japanese national or have special skills.

If you are married to a Japanese national, you only need to stay in Japan for one year if you have been married for more than three years.

In the case of a biological child of a Japanese national, the requirement for permanent residence is satisfied by continuous residence in Japan for at least one year.

Reference: Guidelines for Permission for Permanent Residence by Immigration Services Agency of Japan

2. Cautions for foreign nationals when signing a house loan contract

There is something that foreign nationals should be aware of when signing up for a house loan. Most financial institutions place importance on the permanent residency of foreign borrowers because of the risk of failure to repay the house loan. For this reason, they require that the borrower has permanent residence status, has a Japanese spouse, or has already resided in Japan for a period of time commensurate with permanent residence status.

Many city banks (Mitsubishi UFJ Bank, Mizuho Bank, Sumitomo Mitsui Banking Corporation, Resona Bank, etc.), trust banks, regional banks, etc. require the following conditions for loans:

- Have permanent resident status or have a Japanese spouse

- Be employed and have been paying taxes in Japan (proof of income, taxation certificate, withholding tax certificate, etc. must be submitted)

- Residing in Japan (registered as a resident)

- Can communicate in Japanese

3. General loan requirements by Japanese financial institutions

House loan requirements vary in each financial institution but the following are general loan requirements and outlines for most financial institutions in Japan. House loans are available for the purchase of your own home (a residence for you or your family to live in), home renovation costs, and refinancing.

-

① Requirements for the borrower himself/herself:

-Age Minimum age at application is 20 years old and the maximum age is 65 to 69 years old. Age at the time of full repayment is between 75 and 80 years old -Years of service to the current employer At least 2 to 3 years (exceptions apply) -Annual Income Minimum annual income of about 2-5 million yen -Health condition Ability to obtain group credit life insurance -

② Property Requirements:

-The building must be constructed in accordance with the Japanese Building Standards Law -The land must be under your ownership -

③ Maximum loan amount:

Generally up to 70-80% of the purchase price of the home and up to 90% of the value of the collateral evaluated by the financial institution. The repayment burden ratio must be within a certain range, such as 30% to 35% depending on annual income.

Please see more details in our separate article: final-screening process and eligibility of foreigners -

④ Loan period

1~35 years

-

⑤ Interest rate

Rates vary by interest rate type, including fixed interest, floating interest, and hybrid adjustable interest rate. Fixed interest rates are often from 1.2% to 2.0%, according to the banks you apply for.

4. Financial institutions that handle house loans for foreigners

There are financial institutions that can provide loans for foreign couples and singles without permanent residency. Certain banks offer housing loans exclusively for foreigners who reside in Japan and have a stable income. Please contact our staff > if you want to know the names of the banks who accept foreign applicants without permanent residency. Each financial institution has different loan requirements, including maximum loan amount, years of service, and annual income. These banks tend to have higher interest rates and lower LTV (loan to value ratio of real estate) than general Japanese city banks. The above information is an overview of housing loans based on information from each financial institution and is for reference purposes only. Please note that japanese-architects.com does not guarantee the products or loan requirements of introduced financial institutions. For more detailed information, please contact each bank before applying for preliminary screening.

5. Summary

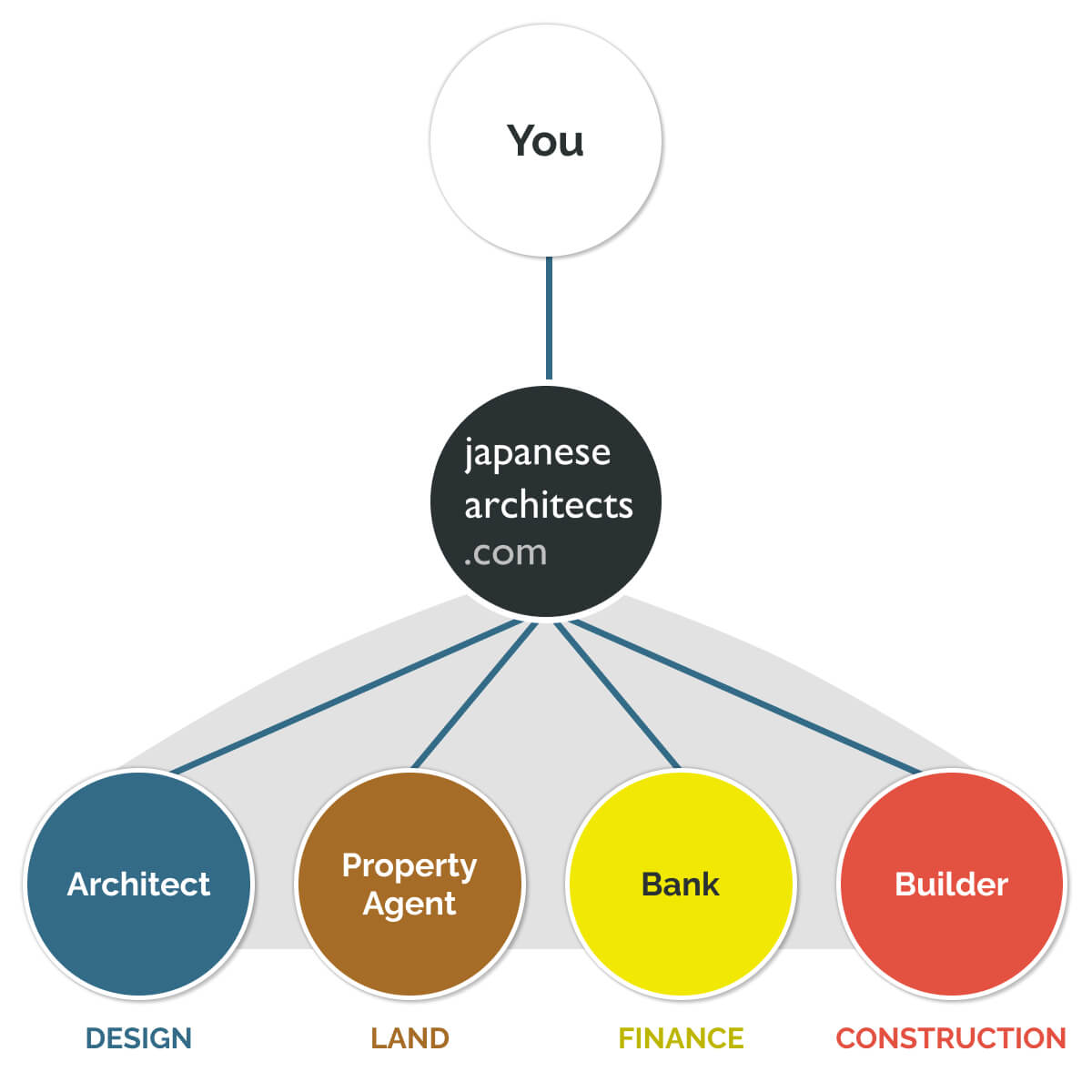

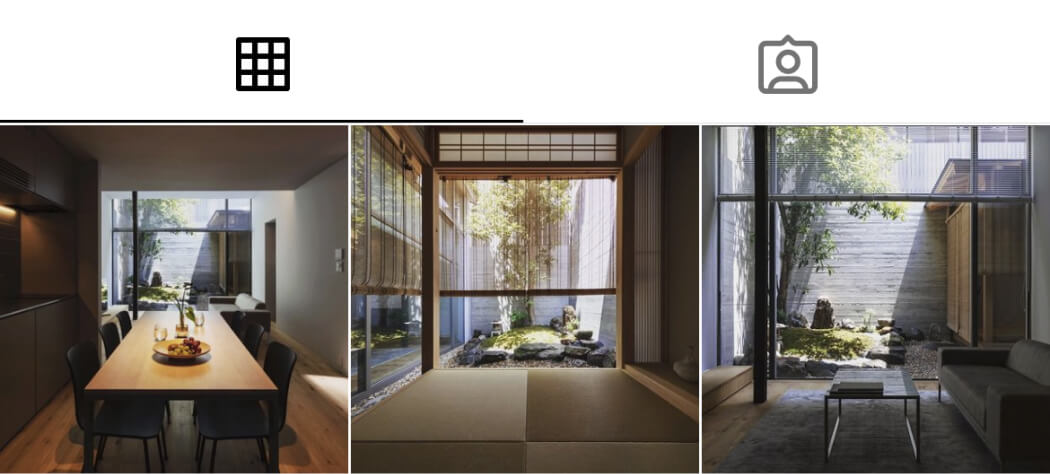

Although it is mostly required for foreigners to possess permanent resident status in order to obtain a loan in Japan, there are a certain number of house loans available for those who do not have permanent residence. Are you planning to take out a house loan but have not yet decided on a plot of land or are having trouble deciding on an architect? If the land and architects are not decided, it is difficult to plan your budget and apply for house loan screening. japanese-architects.com is a platform of English-speaking professionals in Japan who can provide you with complete support throughout the process. We will support you in building your dream house in Japan by connecting the qualified Japanese architects, builders, and financial planners.

No fee, no risk.

A local staff will get in touch with you for tailored support